You’ll Save Your Loved Ones Months of Legal Red Tape, Untold Frustration, and Thousands of Dollars in the Process!

Ask ANYONE who’s suffered through it! Probate is a TAKER – taking time, money and control of one’s estate away from rightful heirs.

What can YOU do to avoid probate?

You can take a few easy steps NOW and set up a REVOCABLE LIVING TRUST to protect your estate — or — you can sit back (with or without a will) and let your state and the Superior Court do your estate planning for you at death.

It’s a FACT! If you don’t do your own estate planning, your state government will do it for you (at death) — via the probate process!

What IS Probate?

Probate is the legal process used to transfer title to assets upon the death of the owner. The process is supervised by the Superior Court in the county of the deceased. Through the probate process, the deceased‘s assets are accounted for, property title cleared, known creditors alerted, heirs notified, and public announcements published so that all who might have an interest in or claim to assets of the deceased have oppor tunity to respond to the court. The entire proc eeding is open to public review.

A Will Does Not Avoid Probate?

Some well-intentioned persons take the time and trouble to prepare a Last Will and Testament, thinking that such a document – duly prepared by a competent attorney – will somehow keep their estate out of probate. Such persons are simply ignorant of the facts, and any attorney who fails to inform them otherwise does them a gross disservice.

While it’s true that a will is an important and helpful estate planning tool, A WILL DOES NOT AVOID PROBATE! It simply tells the probate court the deceased’s wishes respecting the disposition of his assets, and names the appointed representative to carry out those wishes. A will, in this case, becomes the guiding instrument in the probate process.

The deceased’s appointed representative in the will is called an ‘’executor’’ (if a man) or ‘’executrix’’ (if a woman). The ex ecutor normally hires an attorney to represent the deceased before the court and to handle all dealings having to do with the estate. If the deceased died ‘’intestate’’ (without a will), the court will appoint an ‘’administrator’’ and set tle the estate according to the ‘’in testacy” laws of that particular state. These laws will determine how your estate will be adminis tered and what heirs will share in the proceeds after all court costs, legal fees and creditor claims are paid.

So, in summary: If you die with a will, it will be probated. If you die without a will, your state will ‘’provide” you one – the state legal code. It may not be to your liking, but you won’t be around to argue the point.

PROBATE Takes TIME

In addition to their loss of a loved one (that’s YOU), your heirs will also face the frustrations, legal delays and time-consuming red tape inherent in the courts and probate process.

If an estate is small, with few assets (no real estate) and no debts, some states will allow the court to grant petitions for ‘’summary probate.’’ This can result in a simplified process that may take only a few months. Regulations for summary probate will vary from state to state, and will be determined by dollar value of the estate, identity of the heirs and other respective conditions.

The average probate is said to be about 9 months, but to have probate drag on for 18 to 20 months is not uncommon. The wait can become years if the estate is large or there are particular difficulties.

Complex estates, involving real estate ownership, investments, businesses, creditor claims, difficulties between heirs, contestations, and the like can add months and even years to the probate process. And all this time your estate ; including investments, is subject to control of the court.

What about complex multi-million dollar estates? Marilyn Monroe’s estate reportedly took 18 very long and public years, which reduced over $1.5 million down to about $100 thousand for her heirs; John Wayne’s took over 10 years. Bing Crosby’s multi-million dollar estate, however, wasn’t probated at all! Bing had put his estate into one or more living trusts! No probate. No unwanted publicity. No exorbitant costs. Just a smooth transition to his trustees and beneficiaries at death.

PROBATE is EXPENSIVE

In addition to unwanted time and publicity, PROBATE CAN BE EXPENSIVE! The legal establishment gets paid very well (from your estate, of course), and with every dollar the ‘’system’’ and the attorneys take, there is one less dollar for your surviving family members.

Fees are based upon the Gross value (fair market value) of the estate before any payment of debts; they are not based upon the net or equity value. This can come as quite a shock! For example if you died owning assets worth $300,000 and had debts totalling $200,000, the fees would be calcu lated on the $300,000 even though your net worth stood at only $100,000.

What might your probate cost?

Although 4 to 10 percent of the gross estate is considered normal, small estates can sometimes exceed 15 percent and larger more complex estates can sometimes exceed 30 percent.

Some states have a schedule of fixed fees for executors and attorneys, based upon gross value, while other states allow ‘’reasonable fees.’’ States having fixed fees may also allow the court to pay further com pensation for any attorney services that are deemed just and reasonable or ‘’extra ordinary’’ (fees for special services approved at the direction of the judge).

So, probate expenses will vary from state to state. In addition, there are court filing fees, appraiser’s fees, accounting fees, and often the posting of bonds, etc., that take additional dollars from the rightful heirs.

Subscribe: https://dutchflowerpower.shop/subscribe/

About TrustlockUSA

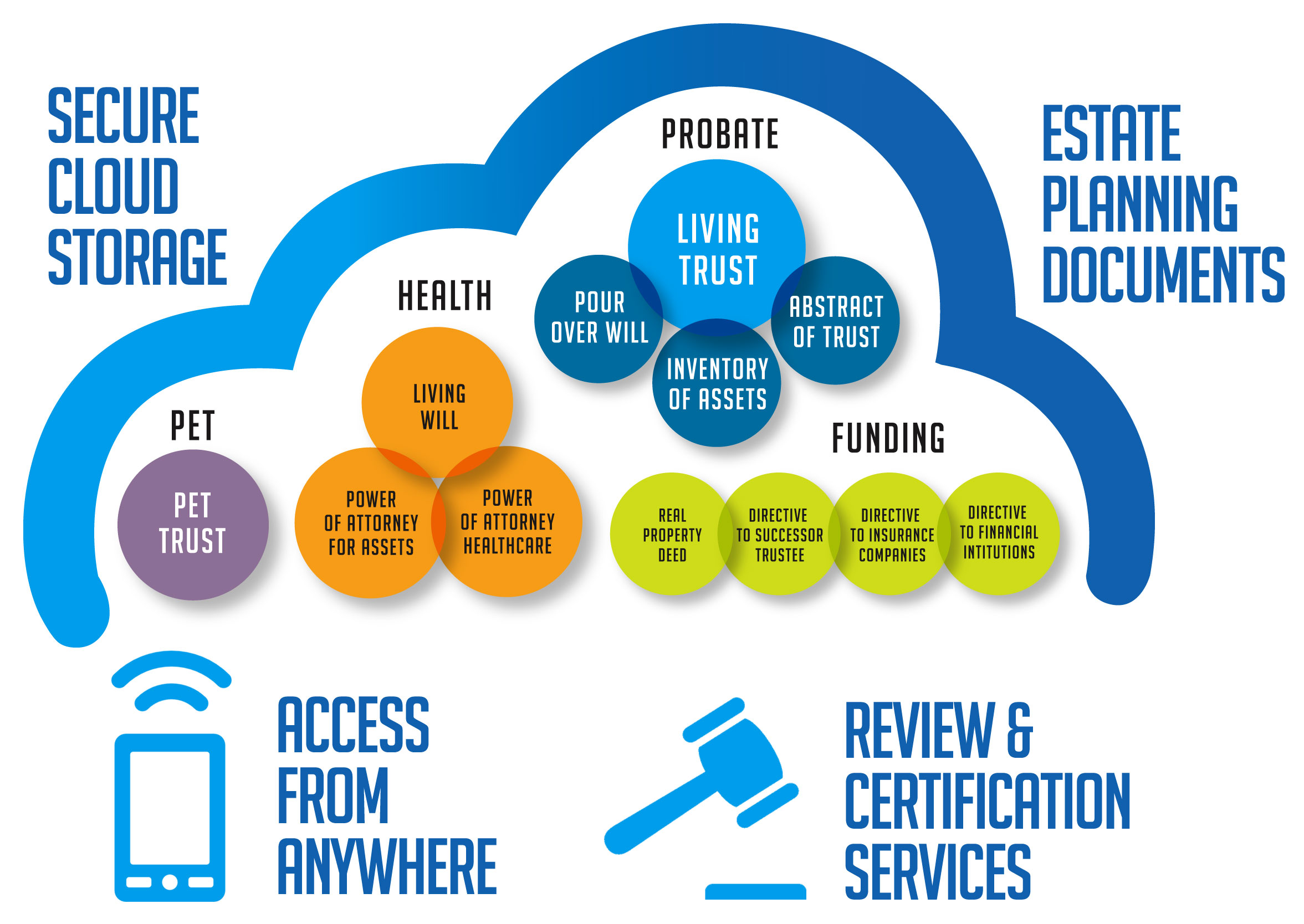

The TrustLockUSA Estate Planning system helps you to create all of your essential estate planning documents. Our Cloud-based system securely gives you and the loved ones you assign, access to all your important legal documents anytime, anywhere in the world using your computer or smart phone.

Tel: +1-727-900-6466

Email: contact@dutchflowerpower.shop

Website: trustlockusa.com